The Single Strategy To Use For Top 30 Forex Brokers

The Single Strategy To Use For Top 30 Forex Brokers

Blog Article

Some Ideas on Top 30 Forex Brokers You Should Know

Table of ContentsThe smart Trick of Top 30 Forex Brokers That Nobody is DiscussingFacts About Top 30 Forex Brokers UncoveredHow Top 30 Forex Brokers can Save You Time, Stress, and Money.Little Known Questions About Top 30 Forex Brokers.The Buzz on Top 30 Forex BrokersNot known Facts About Top 30 Forex BrokersHow Top 30 Forex Brokers can Save You Time, Stress, and Money.The 9-Minute Rule for Top 30 Forex Brokers

Like other circumstances in which they are used, bar graphes offer even more cost information than line charts. Each bar graph stands for one day of trading and includes the opening price, highest rate, most affordable cost, and shutting cost (OHLC) for a profession. A dashboard on the left represents the day's opening price, and a comparable one on the right stands for the closing cost.Bar charts for money trading assistance traders recognize whether it is a customer's or seller's market. Japanese rice investors first utilized candle holder charts in the 18th century. They are aesthetically a lot more appealing and simpler to check out than the chart types explained above. The top part of a candle light is utilized for the opening rate and highest possible price factor of a currency, while the reduced section shows the closing cost and most affordable price factor.

The 10-Minute Rule for Top 30 Forex Brokers

The developments and forms in candle holder charts are made use of to identify market instructions and movement. Several of the a lot more common developments for candlestick graphes are hanging guy - https://qc0x1hvhrlr.typeform.com/to/JXe9Mi4f and shooting celebrity. Pros Largest in terms of everyday trading volume in the world Traded 24 hours a day, five and a half days a week Starting funding can rapidly multiply Usually follows the exact same regulations as normal trading More decentralized than typical supply or bond markets Cons Leverage can make foreign exchange trades extremely unstable Utilize in the variety of 50:1 is typical Requires an understanding of financial principles and signs Less guideline than other markets No earnings producing instruments Foreign exchange markets are the biggest in terms of everyday trading quantity around the world and consequently supply one of the most liquidity.

Financial institutions, brokers, and suppliers in the foreign exchange markets enable a high amount of take advantage of, implying traders can manage huge positions with fairly little cash. Utilize in the array of 50:1 prevails in foreign exchange, though also greater quantities of leverage are available from particular brokers. Take advantage of must be utilized cautiously due to the fact that numerous unskilled investors have experienced significant losses utilizing even more utilize than was essential or sensible.

Getting My Top 30 Forex Brokers To Work

A money trader requires to have a big-picture understanding of the economies of the different countries and their interconnectedness to realize the basics that drive currency worths. The decentralized nature of foreign exchange markets indicates it is much less regulated than various other economic markets. The degree and nature of law in forex markets depend on the trading jurisdiction.

Foreign exchange markets are among one of the most liquid markets in the world. So, they can be less unstable than various other markets, such Exness as genuine estate. The volatility of a particular currency is a function of numerous elements, such as the politics and economics of its country. For that reason, occasions like economic instability in the type of a repayment default or imbalance in trading partnerships with another money can lead to significant volatility.

Get This Report about Top 30 Forex Brokers

The Financial Conduct Authority (https://my-store-f2c59f.creator-spring.com) (FCA) screens and regulates forex sell the UK. Currencies with high liquidity have an all set market and show smooth and predictable rate activity in feedback to outside occasions. The U.S. buck is the most traded currency in the world. It is coupled up in 6 of the marketplace's seven most fluid money sets.

Getting The Top 30 Forex Brokers To Work

In today's info superhighway the Foreign exchange market is no longer only for the institutional investor. The last 10 years have seen a boost in non-institutional traders accessing the Forex market and the advantages it supplies.

Top 30 Forex Brokers - Questions

Foreign exchange trading (forex trading) is a worldwide market for purchasing and marketing currencies - blackbull. 6 trillion, it is 25 times bigger than all the globe's supply markets. As a result, rates alter constantly for the currencies that Americans are most likely to utilize.

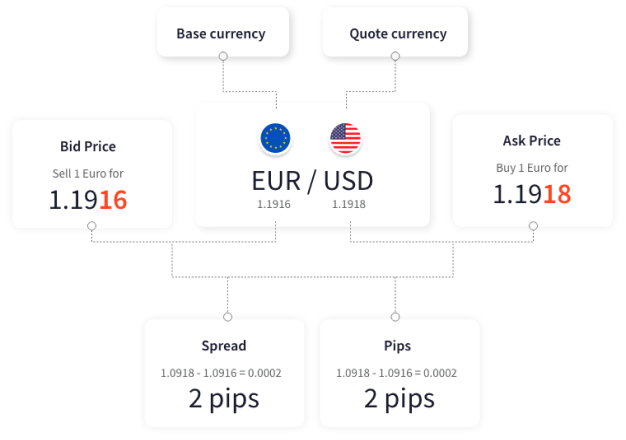

When you sell your money, you get the settlement in a various currency. Every tourist that has actually gotten foreign currency has actually done forex trading. The trader purchases a particular currency at the buy rate from the market maker and sells a different money at the selling price.

This is the purchase price to the investor, which in turn is the profit earned by the market manufacturer. You paid this spread without understanding it when you traded your dollars for foreign currency. You would notice it if you made the transaction, terminated your journey, and after that attempted to exchange the money back to dollars as soon as possible.

See This Report on Top 30 Forex Brokers

You do this when you believe the money's value will fall in the future. If the money rises in value, you have to purchase it from the supplier at that price.

Report this page